Second Order Exponential Smoothing in R

07.30.2021

Intro

Second Order Exponential Smoothing extends Simple Exponential Smoothing by adding a Trend Smoother. If SES doesn’t work well, we can see if there is a trend and add another component to our model to account for that. In this article, we will learn how to conduct Second Order Exponential Smoothing in R.

Data

Let’s load a data set of monthly milk production. We will load it from the url below. The data consists of monthly intervals and kilograms of milk produced.

df <- read.csv('https://raw.githubusercontent.com/ourcodingclub/CC-time-series/master/monthly_milk.csv')

df$month = as.Date(df$month)

head(df)## month milk_prod_per_cow_kg

## 1 1962-01-01 265.05

## 2 1962-02-01 252.45

## 3 1962-03-01 288.00

## 4 1962-04-01 295.20

## 5 1962-05-01 327.15

## 6 1962-06-01 313.65Now, we convert our data to a time series object using the R ts

method.

df.ts = ts(df[, -1], frequency = 12, start=c(1962, 1, 1))

head(df.ts)## [1] 265.05 252.45 288.00 295.20 327.15 313.65Second Order Exponential Smoothing in R"

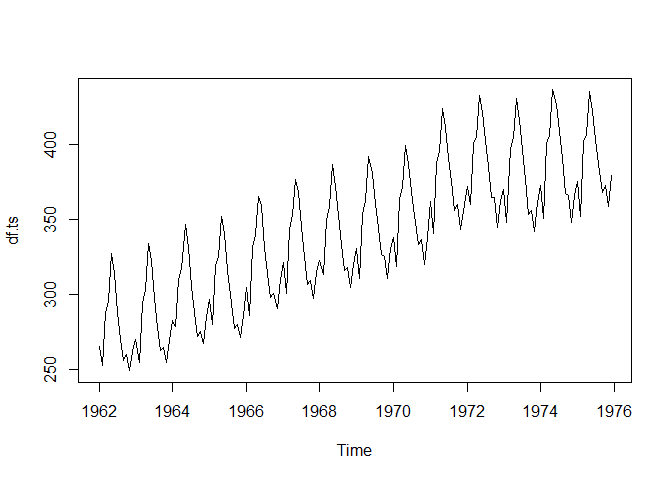

Let’s start by plotting our time series.

plot(df.ts)To create a second order exponential smoothing model, we can use the

holt method from the fpp2 package. Here we can pass our time series,

specify a beta value (our trend smoothing parameter), and specify a

horizon h, how many months out (since our data is monthly).

library(fpp2) ## Registered S3 method overwritten by 'quantmod':

## method from

## as.zoo.data.frame zoo

## -- Attaching packages ---------------------------------------------- fpp2 2.4 --

## v ggplot2 3.3.5 v fma 2.4

## v forecast 8.15 v expsmooth 2.3

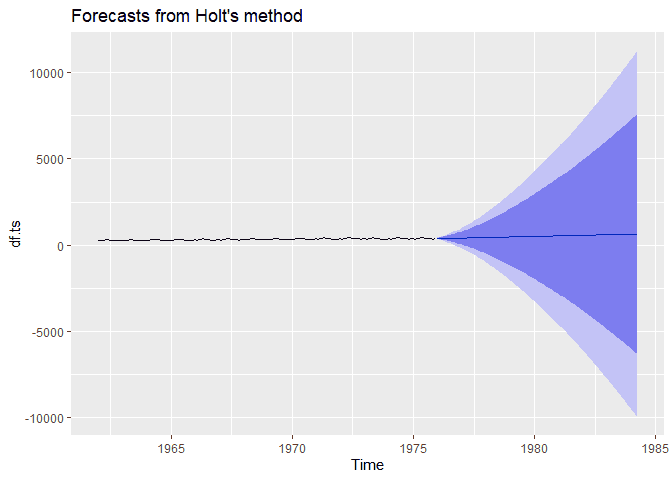

## ses.ts <- holt(

df.ts,

beta = .4,

h = 100

)

autoplot(ses.ts)Second Order Exponential Smothing By Hand

Second order exponential smoothing builds on SES by adding a trend component. If you worked through the ses example, you will be able to solve second order with a sligh modificiation.

The equation for SES is the following: Fi + 1 = α**yi + (1 − α)(Fi − Tt − 1)

Where T_t is the trend smothing component defined as follows:

Tt + 1 = β(Ft − Ft − 1) + (1 − β)Tt − 1

Then, we get the predicted value by:

ŷt + 1 = Ft + Tt

Whe initialize the algorithm as follows

To initialize the first trend, we have multiple options. Here are two common ways:

Now, we move to an example. Let’s say we have the following data.

| t | y |

|---|---|

| 1 | 3 |

| 2 | 5 |

| 3 | 9 |

| 4 | 20 |

We can apply our model as follows. We will use an alpha of .4 and beta of .3.

For t = 1.

Now for t = 2.

ŷ2 = F2 + T2 = 4.2 + 1.76 = 5.96

For t = 3

ŷ2 = F2 + T2 = 5.576 + 1.6448 = 7.2208

For t = 4

ŷ2 = F2 + T2 = 7.93248 + 1.858304 = 9.790784 Let’s finish by writing some simple code to replicate this.

y = c(3, 5, 9, 20)

## Start with the first point

forcast = c(y[1])

alpha = .4

beta = .3

# Initialize

F = y[1]

trend = y[2] - y[1]

for (i in 2:length(y)) {

prev_F = F

F = alpha * y[i - 1] + (1 - alpha) * (F + trend)

trend = beta * (F - prev_F) + (1 - beta) * trend

forcast = append(forcast, F + trend)

}

forcast## [1] 3.000000 5.960000 7.220800 9.790784